ESG Regulations Take Hold in Europe With Other Regions Set to Follow

The EU’s comprehensive sustainable finance action plan aims to mandate that companies integrate sustainability risks into their investment management and disclosure processes, including their impact on the market environment.

Its goals are to:

- Provide greater transparency on ESG investment products

- Use a taxonomy to set a common definition of sustainable activity

- Set market standards for financial products including green bonds, benchmarks and eco labels

Companies are regulated under the Non-Financial Reporting Directive (NFRD) and soon the Corporate Sustainability Reporting Directive (CSRD), while financial products will be regulated under the Sustainable Finance Disclosure Regulation (SFDR).

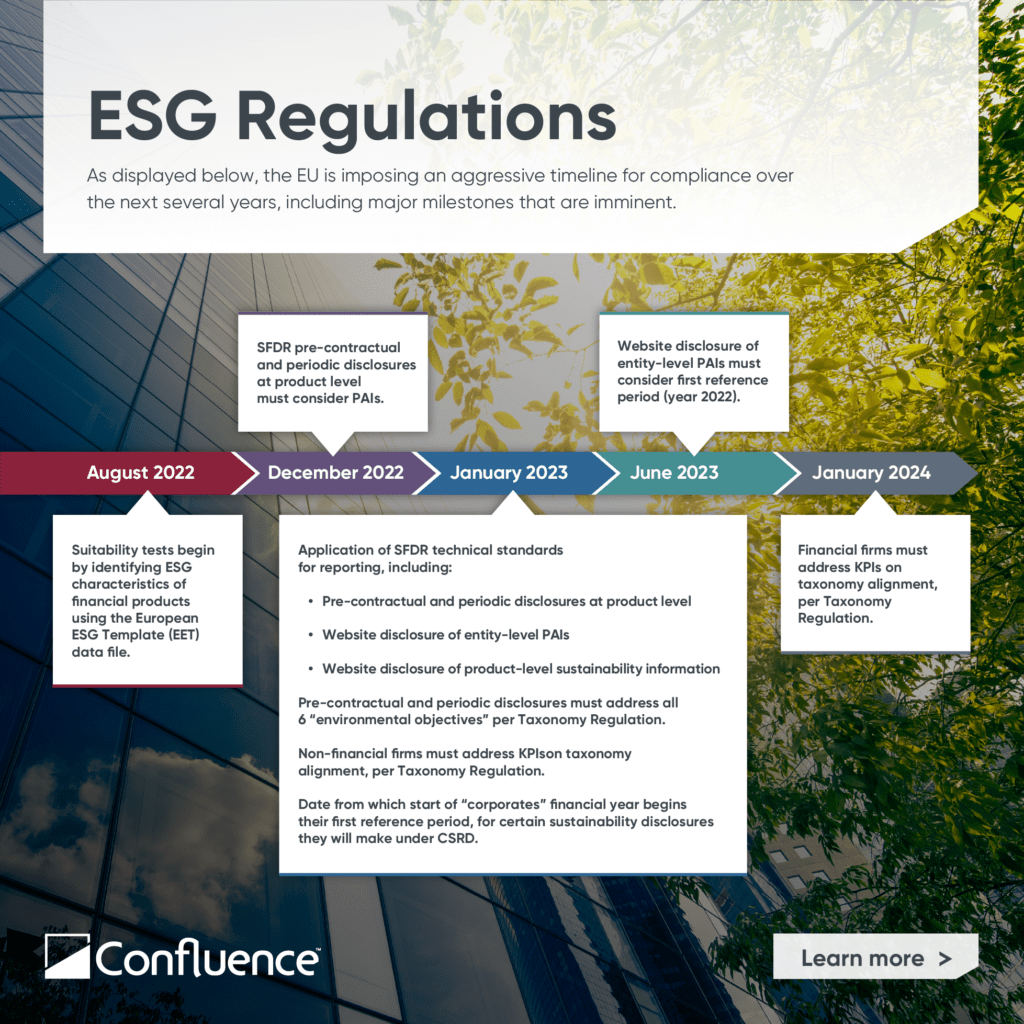

As displayed above, the EU is imposing an aggressive timeline for compliance over the next several years, including major milestones that are imminent. A key challenge is the discrepancy in the timing of disclosure requirements: financial firms are being required to report ESG information which relies on data from corporates — who themselves are not required to disclose that data until later dates.

Meanwhile in the UK, climate-related disclosure requirements have been drafted for the financial sector and corporates, and their dates of implementation follow close on the heels of EU requirements. Contents of disclosures are based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which have emerged globally as the prevailing approach outside of the EU.

The U.S. has also issued climate-related disclosure requirements for both financial firms and issuers. Based on global frameworks such as the TCFD recommendations and the GHG Protocol, the SEC-authored rules are scheduled to be implemented in stages beginning in 2023, and require specific climate-related data to be provided in registration statements, periodic reports, fund prospectuses and other filings.

All these regulations are positive developments designed to enhance and stabilize climate-related disclosures while generating more data to assist all parties with assessing companies’ performance and to drive regulatory reporting.

Subscribe today and receive our latest industry updates and articles.

You may unsubscribe at anytime with our simple “unsubscribe” link at the bottom of each communication. Please see our privacy notices below for further information, including a list of affiliates covered by this consent.