All the Pieces to Complete Your Global Regulatory Compliance Strategy

CSS offers a unique Compliance-as-a-Service (CaaS) platform that gives you complete control of your global regulatory compliance program, coupled with the support of market-leading regulatory expertise and managed services. Meet mandatory regulatory requirements while strategically optimizing data, operations and technology.

Let’s Talk Technology.

First, Know Where Gaps Exist

CSS works with every firm to understand exactly where the gaps are in your global compliance program and guide you down the regulatory path from a tactical to strategic approach to compliance.

We will:

- Analyze existing processes to see where you have room for improvement and the roadblocks impeding your progress.

- Identify savings by transitioning specific compliance processes and tasks to an automated solution or managed services.

- Plan and implement your future compliance strategy to achieve maximum operational efficiency, scalability, risk mitigation and value creation.

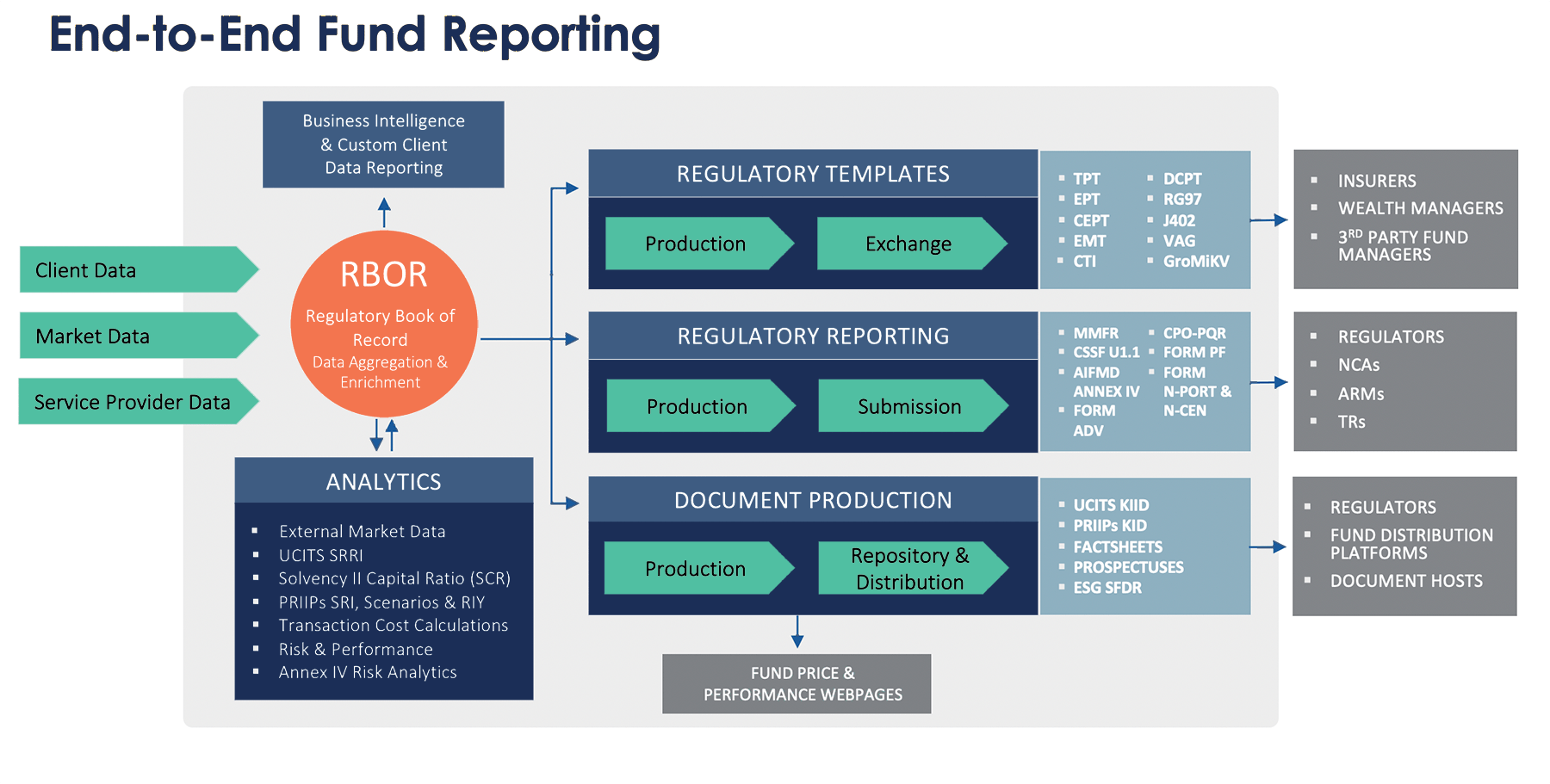

Fund Reporting

Most robust end-to-end technology solution available

CSS delivers a complete end-to-end fund reporting solution that is unmatched in the market for depth and breadth of coverage, leveraging integrated data management, regulatory reporting software and document production capabilities.

Regulatory Book of Record (RBOR)

The global Fund Reporting solution is built on a centralized data management system for regulatory data aggregation and enrichment. The Regulatory Book of Record (RBOR) retrieves, validates and normalizes data from multiple data sources, including client data, market data and service provider data.

Analytics

Provides inputs to the Regulatory Book of Record (RBOR), from cost of executing trades to cost and charges and performance metrics. In addition, fund performance comparison, risk analysis and portfolio monitoring functionality is available via Longboat Analytics in Ireland, Italy, South Africa and Sweden.

Learn more about Longboat Analytics: fund analytics, data and website solutions here.

View Details

- Enrichment with External Market Data

- UCITS SRRI

- Solvency II Capital Ratio (SCR)

- PRIIPs SRI, Scenarios & RIY

- Transaction Cost Calculations

- Risk & Performance

- Annex IV Risk Analytics

Regulatory Templates

The CSS platform automates the production and exchange of regulatory templates, or industry-accepted data sets, to insurers, wealth managers and third-party fund managers, including:

View Details

- TPT (Solvency II)

- EPT (PRIIPs)

- CEPT (PRIIPs)

- EMT (MiFID II)

- CTI (Cost Transparency Initiative)

- DCPT / FVPT (DC Pensions – FCA COBS 19.8)

- RG97 (ASIC)

- J402 (Dutch Pensions)

- VAG (Germany)

- GroMiKV (Germany)

These services also include underlying performance and risk analytics, as well as the transaction cost calculations as required.

Regulatory Reporting

The CSS platform provides periodic filings to regulators, NCAs, ARMs and TRs across multiple jurisdictions, including:

View Details

- MMFR

- CSSF U1.1

- AIFMD Annex IV

- CPO-PQR

- Form PF

- Form ADV

- Form 13F

- Open Protocol

- Form N-PORT

- Form N-CEN

- TIC BC / BL-1 / BL-2 / BQ-1 /

- BQ-2 / BQ-3 / CQ-1 / CQ-2 / D / S / SHC / SGL / SLT / TFC 1/2/3

Document Production & Distribution

Easily navigate and manage the complexities of the production and distribution of factsheets, prospectuses and other key documents such as the EU Sustainable Finance Disclosure Regulation (SFDR) focused on ESG, UCITS KIID and PRIIPs KID.

View Details

Harness the flexibility of a modular, multilingual, multi-jurisdictional solution that covers a full range of regulatory reporting requirements for the production and distribution of documents.

Utilize multi-tenant SaaS proprietary software that allows you to automate the production and distribution of all your regulatory and marketing reporting.

Investment Monitoring

Compliance never sleeps. Stay ahead of regulatory changes

CSS automates and simplifies shareholder disclosure, sensitive industries and position limit monitoring to help investment managers and financial institutions stay ahead of regulatory changes across global jurisdictions, reduce risk and optimize operational efficiency. The platform uniquely pairs unmatched in-house regulatory expertise with the most comprehensive set of industry legal data from aosphere.

From short selling bans to sensitive industry changes, regulations and rules are monitored and updated automatically in the Investment Monitoring platform in near real-time, so you can pivot quickly to rapidly changing regulatory requirements. The breadth and depth of global coverage includes:

Shareholding Disclosure: 100+ jurisdictions

Core to the Investment Monitoring platform, the Shareholding Disclosure module provides near real-time automated monitoring and reporting for beneficial ownership thresholds, including long, short, issuer and takeover panel reporting in more than 100 jurisdictions. The platform compares your firm’s holdings to relevant thresholds, provides alerts when action is required and generates disclosure notifications that can be filed with regulators.

- Access to the most comprehensive set of legal data on shareholding disclosure obligations in the market through a collaboration with aosphere, complemented by CSS’s team of in-house regulatory guidance experts

- Automated integration with regulator, exchange and reference data sources

- Daily and intra-day processing with integrated workflow, custom alerts and filling notifications for high-volume portfolios, including derivatives and index looks through with focus on exception handling

- Automatically generate a pre-populated notification form depending on relevant jurisdiction or regime and has more than 140 pre-populated forms available

- Ability to handle complex entity and fund structure aggregation challenges

Our Difference:

- Operational Efficiency and Scalability: Optimize compliance workflow by managing global jurisdictions and thresholds via automation rules, calculations and aggregation logic

- Repeatable Automation: Instructions on the filing process and automated submissions ensure a repeatable and reliable workflow

- Flexible & Customizable Platform: Choose the jurisdictions, rules and alerts that match your firms’ needs

- Risk Mitigation: Ensure accuracy through data validations, approval workflow and management reporting

Shares Outstanding

An add-on capability to Shareholding Disclosure, the Shares Outstanding service helps investment managers easily source required voting and share capital data from exchanges, regulators and third-party data providers.

Shares outstanding data is required when evaluating holdings against thresholds but is notoriously complex to obtain and maintain accurately due to corporate actions, jurisdictional nuances and the number of sources that are available.

CSS’s Shares Outstanding service simplifies the acquisition of up-to-date voting and share capital data by leveraging up to six sources to determine the best number to use during threshold analysis.

Sensitive Industries: 99 jurisdictions

Sensitive Industries refer to two distinct types of investment restrictions:

- Foreign direct investment (FDI) restrictions, often part of national security screenings of incoming foreign capital

- Sector-specific investment restrictions applicable without regard to nationality.

Nearly every financial jurisdiction has specific industries that are considered “sensitive to the continuation of government and public needs.” These industries can range from defense and media, to power distribution, utilities and financial infrastructure. Some of these industries are even unique to the individual country. Financial firms find sensitive industries challenging because these rules are specified by the jurisdiction with no universal overseeing regulatory body.

The Sensitive Industries module of CSS’s Investment Monitoring solution provides automation rules that cover 99 jurisdictions evaluating foreign investment restrictions and industry-specific limits, customizable warnings on approach and violation alerts when crossing a reportable threshold.

With jurisdiction rules changing frequently, investment managers need the regulatory agility to keep up with the pace of regulatory change. CSS’s collaboration with aosphere provides access to their in-depth and robust library of regulatory rules and sensitive industries, while CSS’s in-house team of regulatory guidance experts analyzes and verifies these rules and delivers additional details or standards where required or sourced.

- The workflow incorporates a rapid rule deployment process that allows the platform to make near real-time updates to adapt quickly to the volatile regulatory landscape

- Provides a host of reporting for a real-time view of rule definitions and exportable drill-down reports to dig quickly into any violation that may occur

- Supports multiple types of industry codes (ICB/FTSE Russel, BICS, and GICS codes) and complex hierarchy structures

- As with the Shareholding Disclosure module, customize the sensitive industries, rules and alerts that match your firms’ needs with flexible workflow and exportable reports

- Access to regulatory summaries for the European Union, European Economic Area and India, providing simple explanations of the rule requirements and reporting locations

Position Limit Monitoring: 50+ exchanges (plus CFTC and MiFID II)

The Position Limit Monitoring module of Investment Monitoring is a fully automated solution for the daily sourcing and tracking of exchange and regulator-imposed limits on futures, options and other derivative instruments.

The platform sources position limits and accountability levels daily on 50+ exchanges (plus CFTC and MiFID II).

- Data Management: Translates market data and product codes from source systems to exchange or regulator commodity codes

- Headroom View: Configurable and exportable headroom report shows all holdings subject to exchange and/or regulator limits

- Transparent Workflows: Drill-through capability to portfolio level detail

- Custom Alerting: Automated notifications triggered for warnings and violations with email notification capability and configurable warnings as a percentage of a limit

- Spot Calendar: Calculates and tracks when your positions enter the spot effective period for each product.

In-house regulatory guidance experts

Complementary shareholder disclosure data from aosphere (an affiliate of Allen & Overy LLP)

Comprehensive, global coverage across jurisdictions, exchanges and sensitive industries

Near real-time updates and alerts for regulatory agility

Transaction Reporting

Capture, consolidate and report all required transaction data

Built on experiences from EMIR and MiFID II, CSS’s multi-regulatory platform seamlessly integrates with your source systems, giving financial firms the flexibility to adapt to rapidly changing regulations and requirements from ESMA, Trade Repositories, ARMs, EUNCAs and other global regulators like ASIC, MAS and HKMA.

- MiFID II Transaction Reporting MiFIR Art. 26

- MiFID II Position Limits Art. 58

- EMIR

- SFTR

- Money Market Statistical Reporting (MMSR)

Transaction Reporting Workflow

The CSS Transaction Reporting solution is an agnostic platform that converts client data into the formats required by TRs/NCAs/ARMs.

- Has the capability to consolidate transaction data and static data to secure complete reporting

- Data validations built in, including eligibility checks with FIRDS and GLEIF for accurate ISIN and LEI, that ensure the correctness and quality of the data

Reconciliation

The Transaction Reporting platform offers reconciliation of delegated reporting by retrieving trade data from client source system and reconciling it with trading data from the appropriate trade repository.

- Trades matched directly via UTI or based on configurable criteria

- Matching result is displayed with status, unmatched fields and the source of mismatch – client’s source system or trade repository

One centralized, multi-regulation platform to think about transaction reporting more strategically

Seamless integration with source systems and platforms

Normalized, consolidated transaction data via RBOR (Regulatory Book of Record)

Future-proof reporting

Leverage the GTR community of in-house regulatory experts, partners and thought leaders

Compliance Management

Build the framework for a highly efficient, strategic compliance program

Streamline and automate core compliance functions in a centralized platform with integrated workflow. Facilitate documentation and promulgation of policy, procedures and manuals, manage complex attestations and reporting, as well as workflows, task management, calendars and alerts to create an enterprise-wide compliance program.

Code of Ethics

Automate and centralize employee-related compliance obligations. An add-on module to Compliance Management, Code of Ethics automates the monitoring of employee compliance obligations.

- Automated pre-clearance rules and approvals for personal trading, private placements, gifts and entertainment, political contributions and outside business activities (OBAs)

- Direct brokerage feeds for 20+ brokers that automate the loading of employee trading activity

- Customizable personal trading rules engine with security based and trading based options

- Automated restricted list, alerting and notifications

- Side-by-side surveillance reports on employee trading patterns, including the comparison of personal trading to firm trading activity for instances of same day trading, employee better price and front-running

- Robust security master from a trusted third-party partner

Trade Surveillance

Have complete transparency into your firm’s trading activities. An add-on module to Compliance Management, Trade Surveillance automates the monitoring of trading activity to comply with internal policies and regulatory requirements. The module connects directly to client trading systems, providing your compliance team with timely compliance alerts, risk management workflow tools and post-trade compliance risk reporting.

- Standard post-trade surveillance reports for dozens of compliance tests:

- Insider Trading

- Allocation Testing

- Cross Trades

- Trade Errors

- Side-by-Side Conflicts

- Short-Term Trading

- Transaction Cost Analysis

- Volume Profiles

- Multi-asset and multi-jurisdiction coverage

- Leading third-party data integrations for Transaction Cost Analysis, material news and events, and market pricing

- Processes a daily transaction, holdings, and/or cashflow file via SFTP or API

- At-rest and in-transit encryption

- Creation of policies & procedures

- Conduct risk assessments

- Code of Ethics

- Trading analytics and surveillance

- Compliance calendars and alerts

- Task management and follow up

- Conflicts of interest: Gifts, political contributions, outside activities, etc.

Regulatory Book of Record (RBOR)

Easily source and centralize regulatory data from disparate systems

In today’s complex and fragmented regulatory space, you need to treat data as an asset, and aggregating and standardizing disparate regulatory data is imperative. CSS’s Regulatory Book of Record (RBOR) is the first centralized data management system for regulatory data aggregation and enrichment across CSS’s global regulatory compliance platform. CSS’s RBOR builds comprehensive links between data sets, unravels duplicate source data integrations and reduces manual aggregation.

Rules-based software engine

One centralized warehouse of all regulatory-facing data

Derive more value from data

Powerful analytics capabilities

Start the Conversation

Take the first step on your global regulatory compliance journey. A CSS regulatory expert will be in contact with you within the next business day.

Subscribe today and receive our latest industry updates and articles.

You may unsubscribe at anytime with our simple “unsubscribe” link at the bottom of each communication. Please see our privacy notices below for further information, including a list of affiliates covered by this consent.