ESG Disclosures by Investment Firms: A Comprehensive Look at the SEC’s Proposal

On May 25th the SEC proposed an ESG disclosure framework for investment advisers and funds, examined in detail below. With this information, investment firm compliance and operations personnel can gain an understanding of the narrative and quantitative data that would be required of them, and where exactly that will need to be disclosed.

This latest Proposal follows a separate regime the SEC proposed for issuers, in March, which you can read about in our previous analysis.

Background

The SEC’s May 25th Proposal for financial firms doesn’t come as a surprise, given signals from SEC Commissioners over the past 18 months with respect to ESG. One of the strongest signals came from Commissioner Caroline Crenshaw in December 2021, when in a webinar she suggested that the SEC’s upcoming disclosure regimes are but the initial stages of ongoing regulatory efforts to curtail the financing of harmful emissions:

“One way I am thinking about this problem is how the creative and well-sourced participants in our markets will seek just to continue to turn a buck on high emitting businesses after climate reporting regimes are put in place.”

Such discussions are useful to track from a compliance perspective, as they can suggest what priorities SEC Commissioners will focus on. During that particular session, titled “Wall Street’s Carbon Bubble” and hosted by the Center for American Progress and the Sierra Club, Commissioner Crenshaw praised their research gathering, which showed that in 2020 just eight banks and 10 asset managers in the US financed over two billion tons of CO2 gas emissions, representing greater emissions than all but four countries in the world.

While Commissioner Crenshaw made it clear that her views do not necessarily represent those of the SEC generally, five months later she would be joined by her colleagues Allison Herren Lee and Gary Gensler in approving the SEC’s new disclosure proposal for financial firms, by a 3-1 vote, with Hester Pierce the dissenting Commissioner.[i]

Firms in scope

The SEC’s Proposal covers registered investment funds, registered advisers, exempt reporting advisers and business development companies. While it does not directly mandate disclosures by private funds[ii], it requires reporting investment advisers (with private funds as clients) and reporting registered funds (with private funds in their portfolios) to consider the ESG related activities of private funds.

Defining “ESG”

In stark contrast to the EU’s ESG disclosure regime for investment firms (in effect since March 2021), the SEC’s Proposal doesn’t seek to define “ESG”, beyond spelling out “environmental, social and governance”. Whereas the EU’s frameworks under SFDR and the Taxonomy Regulation go to great lengths to precisely categorize a multitude of economic activities that may be deemed “sustainable” (as well as incorporating social and governance standards based on international conventions), the SEC states plainly and without elaboration: “We are not proposing to define ‘ESG’ or similar terms.”[iii]

The legal traditions of the United States (grounded in common law) and most of Europe (based on codified law) render these contrasting approaches familiar to us. But in the case of “sustainability” or “ESG”, important practical realities are also at play. Even before the first major set of technical disclosures have come due in the EU (starting on 1 January 2023), its regulators have increasingly had to grapple with both localized interests and world developments that can shape what “sustainable” or “ESG” should mean. Thus nuclear and gas power, typically viewed as energy sources that can present meaningful risks to environmental sustainability, are now qualifying sustainable economic activities under the EU’s disclosure regime, following lobbying from some EU Member States. Even military weaponry, often excluded from investment policies in the same breath as tobacco, gambling and adult content, has been the subject of a sustainability re-assessment by some, following Russia’s invasion of Ukraine.

The SEC is of course well aware of these issues and — with the luxury of being able to watch the EU act first in ESG regulation — it has no doubt drawn many lessons. One of those appears to be staying away from the potential hornet’s nest of trying to define “ESG”, at least for the time being.

Compliance dates

With the Proposal’s effective date being 60 days after its publication in the Federal Register, the relevant types of firms are required to disclose the mandated ESG related information on the following forms, beginning on the following dates:

- One year after the effective date, for the following measures:

- fund disclosure requirements in prospectuses, on Forms N-1A and N-2 (REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 and/or REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940)

- disclosure requirements for UITs, on Form N-8B-2 (REGISTRATION STATEMENT OF UNIT INVESTMENT TRUSTS WHICH ARE CURRENTLY ISSUING SECURITIES) and Form S-6 (FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933 OF SECURITIES OF UNIT INVESTMENT TRUSTS REGISTERED ON FORM N-8B-2)

- fund regulatory reporting on Form N-CEN (ANNUAL REPORT FOR REGISTERED INVESTMENT COMPANIES)

- adviser disclosure requirements and regulatory reporting on Form ADV (UNIFORM APPLICATION FOR INVESTMENT ADVISER REGISTRATION AND REPORT BY EXEMPT REPORTING ADVISERS), Parts 1 and 2

- 18 months after the effective date, for the following measures:

- fund disclosures in the annual report to shareholders and on Form N-CSR (CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES)

Fund prospectus disclosures

The Proposal adds various items and instructions within Form N-1A and Form N-2, the registration statements for open-end and closed-end funds respectively, which contain in their “Part A” the information required in a fund prospectus. Registered funds, that consider ESG factors in their investment decisions, would need to disclose in their prospectus certain ESG information, depending on which category of “ESG fund” they fall into.

ESG integration fund

“ESG integration funds” are those that integrate ESG factors alongside non-ESG factors in their investment decisions. The Proposal requires them to describe how ESG factors are incorporated into their investment process, and what those factors are (in addition to the information funds currently must provide in their prospectuses about their investments, risks and performance). Open-end funds would provide this information “in a few sentences” in the summary prospectus, and in more detail in the statutory prospectus. Closed-end funds (which do not use a summary prospectus) would provide this information in brief within the general description of the fund, and in more detail later in the prospectus. Funds considering GHG emissions in their investment decisions must also describe, in the summary prospectus (or for closed-end funds, later in the prospectus), what methodology they use to do so.

ESG focused fund

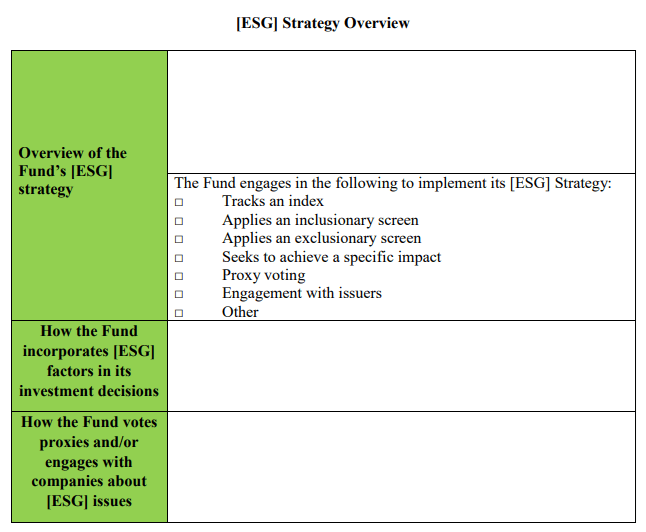

“ESG focused funds” are those making ESG a significant consideration in their investment decisions. They would be required to provide more detailed disclosures including, in the prospectus, the following standardized ESG strategy overview table:

See SEC Proposed Rule, TEXT OF PROPOSED RULE AND FORM AMENDMENTS, Form N-1A (p. 318) and Form N-2 (pp. 333).

Open-end funds would provide this table at the beginning of the risk/return summary section, and closed-end funds at the beginning of the discussion of their organization and operation. Digital versions of the table would need to include hyperlinks to more detailed ESG information (required elsewhere in the prospectus).

ESG impact fund

“ESG impact funds” are a subset of ESG focused funds that seeks to achieve a particular impact related to ESG. They would be required to make the disclosures that an ESG focused fund makes, as well as provide additional information about their impact objectives and progress.

To consult the SEC’s textual amendments to Part A of Form N-1A and Form N-2, governing fund prospectus disclosures, see pages 316-322 and pages 331-337 of the Proposal, respectively.

Disclosures by unit investment trusts (UITs)

The SEC proposes that UITs, that employ ESG factors in their investment decisions, be required to describe briefly how those ESG factors considered. As these entities are unmanaged, the disclosure requirements for them are less detailed than for other types of funds. (They need not, for example, differentiate between “ESG integrated” or “ESG focused” investment selection.)

UITs would set forth this information in their Form N-8B-2 registration statement (and in their prospectus as required by Form S-6). The SEC’s proposed additional text in Form N-8B-2 can be read at pages 346-348 of its Proposal.

Fund annual report disclosures

Under the Proposal, registered investment companies would need to disclose additional ESG related information in their annual reports. These are detailed in new instructions the SEC would add within Form N-1A and Form N-2. The ESG information would need to appear in the annual report’s section on management’s discussion of fund performance, while business development companies would need to provide it in the section on management’s discussion and analysis. Funds for which proxy voting (or other engagement with the issuer) is significant to their ESG strategy would be required to disclose how they voted (or engaged with the issuer) on ESG issues. ESG impact funds would need to address their progress on achieving their particular ESG impact, in qualitative and quantitative terms.

GHG emissions data

ESG focused funds, that consider GHG emissions as part of their investment strategies, would need to disclose the aggregated GHG emissions of their portfolios, expressed in metric tons of CO2e.[iv] A “portfolio” includes an ESG focus fund’s underlying investee companies or funds. Such underlying funds may be registered or private funds[v], but would not include money market funds.

For their calculations, ESG focused funds would need to obtain financial information about their portfolio companies (e.g. enterprise value, total revenue) from their most recent SEC filings (such as Form 10-K reports, or Form 20-F for foreign private issuers). In the absence of such information from filings, the fund could obtain it directly from the portfolio company. For calculations requiring a fund’s net asset value, or the value of holdings in a portfolio company, a fund could use figures from its most recent fiscal year end. (The SEC acknowledges that differing fiscal year-end dates being used for funds and their portfolio companies could produce data anomalies, but lives with this issue in the name of simplicity.)

In sourcing a portfolio company’s Scope 1 and Scope 2 GHG emissions data, an ESG focused fund could look to the company’s most recent regulatory report. If not available there, the data could be obtained from another publicly available document of the company, such as a sustainability report. Absent any such public disclosure, the ESG focused fund would be entitled to make a good faith estimate of the company’s Scope 1 and Scope 2 GHG emissions. Such estimate need not adhere to a strict standard, and could be based on data from third party providers.[vi] A fund making good faith estimates would be required to disclose the percentage of its portfolio’s total GHG emissions that is based on such estimates, to describe the process it used to make its estimates, and to provide additional information on its Form N-CSR about its methodologies and assumptions employed.

Where an ESG focused fund invests in another sustainable fund, it would report its pro-rated share of that underlying fund’s GHG emissions. If the underlying fund itself is required to report its GHG emissions, the ESG focused fund could use that data. Otherwise, the ESG focused fund would identify the underlying fund’s portfolio holdings (based on the underlying fund’s most recent financial statements), use those companies’ GHG emissions data, and apply its pro-rata share.

As for “Scope 3” GHG emissions data, the SEC’s Proposal requires an ESG focused fund to disclose it only to the extent it has been reported by portfolio companies. In the absence of that information, a “good faith estimate” is not required (as it is for Scope 1 and Scope 2 emissions).

GHG emissions calculations

For calculating GHG emissions the Proposal requires the inclusion of derivatives, related to underlying companies, based on the notional amount invested by the ESG focused fund. Derivatives are defined to include security-based swaps, futures contracts, forward contracts, options, any combination thereof, or any similar instrument. Investments in interest rate swaps, cash or foreign currencies would not need to be included (as such instruments are not linked to underlying entities with GHG emissions). Note also that a fund’s short sale of a security would not reduce an investee company’s deemed GHG emissions, nor would a company’s use of carbon offsets.

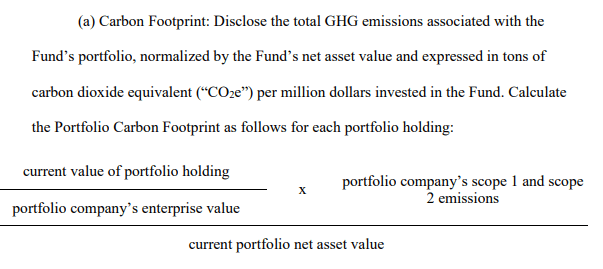

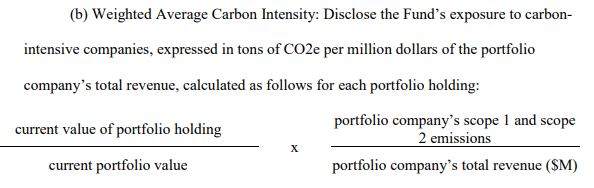

The Proposal requires calculation of GHG emissions based on both “carbon footprint” and “weighted average carbon intensity (WACI)”. The SEC points out that these metrics align with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Partnership for Carbon Accounting Financials (PCAF), and are based on emissions data standards of the GHG Protocol.

Carbon footprint should be calculated as follows, according to this excerpt from the SEC’s proposed instructions:

The WACI calculation for GHG emissions is described as follows:

See SEC Proposed Rule, TEXT OF PROPOSED RULE AND FORM AMENDMENTS, Form N-1A (pp. 324-25) and Form N-2 (pp. 339-40).

The above-described calculations for ESG focused funds relate to Scopes 1 and 2 GHG emissions data. For Scope 3 GHG emissions, an ESG focus fund would provide this data separately, and broken out by industry. Only the “carbon footprint” metric would be required, not the “WACI” calculation.

GHG is defined in the Proposal in alignment with the GHG Protocol.[vii] Thus for a fund subject to these disclosures, Scopes 1, 2 and 3 GHG emissions are defined as follows:

- Scope 1 – Direct GHG emissions from operations that are owned or controlled by the fund’s portfolio company.

- Scope 2 – Indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a portfolio company.

- Scope 3 – All indirect GHG emissions not otherwise included in a portfolio company’s Scope 2 emissions, which occur in the upstream and downstream activities of a portfolio company’s value chain. The Proposal describes “upstream” and “downstream” activities as follows:

- “Upstream activities in which Scope 3 emissions might occur include: a portfolio company’s purchased goods and services, a portfolio company’s capital goods; a portfolio company’s fuel and energy related activities not included in Scope 1 or Scope 2 emissions; transportation and distribution of purchased goods, raw materials and other inputs; waste generated in a portfolio company’s operations; business travel by a portfolio company’s employees; and a portfolio company’s leased assets related principally to purchased or acquired goods or services.”

- “Downstream emissions in which Scope 3 emissions might occur include: transportation and distribution of a portfolio company’s sold products; goods or other outputs; processing by a third party of a portfolio company’s sold products; use by a third party of a portfolio company’s sold products; end-of-life treatment by a third party of a portfolio company’s sold products; a portfolio company’s leased assets related principally to the sale or disposition of goods or services; a portfolio company’s franchises; and investments by a portfolio company.”

SEC Proposed Rule, Sec. II. DISCUSSION, A.3 (p. 99, ft. 155).

To view the SEC’s newly proposed text governing annual report disclosures, within Form N-1A and Form N-2, see pages 322-330 and pages 337-346 of the Proposal, respectively.

Inline XBRL data tagging

The SEC Proposal requires funds to file their ESG-related registration statement and annual report disclosures in the structured, machine readable data language Inline XBRL, so that investors, data aggregators and others can automate their analysis of the ESG information.

Investment adviser brochure disclosures

Investment advisers would be required to provide ESG related information in their brochures, disclosed within Formulaire ADV at Part 2A, as follows.

Item 8: Methods of Analysis, Investment Strategies and Risk of Loss

The SEC proposes a new Item 8.D, requiring a description of ESG factors the adviser considers for each significant investment strategy or method of analysis. The disclosure should differentiate between “ESG integration”, “ESG focused” and “ESG impact” strategies (similar to funds’ disclosures). Advisers should also set forth criteria or methodologies they use to evaluate their investments based on ESG factors.

Item 10: Other Financial Industry Activities and Affiliations

Item 10.C is proposed to be amended, to require the adviser to describe any material arrangement that it has with any related party that is an ESG consultant or other service provider (for example an ESG index provider or ESG scoring provider). The SEC notes that this is meant to address conflicts of interest: if the adviser’s related party provides ESG ratings or an ESG index, the adviser could be incentivized to engage that ESG provider’s services.

Item 17: Voting Client Securities

The Proposal amends Item 17.A to require advisers, with voting policies that include ESG considerations, to describe the ESG factors they consider.

Wrap Fee Brochure (Form ADV, Part 2A, Appendix 1)

As advisers sponsoring wrap fee programs[viii] must prepare a specialized brochure for their wrap fee clients, such advisers considering ESG factors in their programs would be required (in Item 4 of their wrap fee brochure) to describe how they incorporate such ESG factors.

Currently, Item 6 of the wrap fee brochure requires advisers to describe how they select portfolio managers and calculate their performance for their wrap fee programs. The Proposal amends Item 6 to also require advisers that consider ESG factors to describe the following:

- The criteria or methodology they use to assess portfolio managers’ applications of the ESG factors (e.g. if the portfolio manager compares its ESG impacts to an ESG benchmark or ESG index, or follows a global ESG framework).

- Whether the adviser, or a third party, reviews portfolio managers’ applications of the ESG factors. If so, the nature of the review and identity of the reviewer. If not, the reasons why not.

An additional proposed disclosure is based on Item 6.C of the wrap fee brochure. That provision requires an adviser, that serves as both a sponsor of and a portfolio manager for a wrap fee program, to describe the investments and strategies it will use as a portfolio manager. The Proposal would amend Item 6.C to require that such sponsor-managers, considering ESG factors significantly in their wrap fee programs, complete the new Item 8.D of the adviser’s brochure (as described above, requiring a description of the ESG factors the adviser considers for each significant strategy or method of analysis).

To view the SEC’s proposed changes within Form ADV Part 2, see pages 358-362 of the Proposal.

Fund and adviser regulatory reporting

Form N-CEN (ANNUAL REPORT FOR REGISTERED INVESTMENT COMPANIES)

The SEC proposes to amend Formulaire N-CEN, to provide census-type information to investors in a structured data language, about ESG funds and their service providers. The Proposal would add Item C.3(j), requiring funds that incorporate ESG factors to report the type of ESG strategy they employ, the ESG factors they consider and the method they use to incorporate those factors. Such funds would also need identify themselves as an ESG integration fund or an ESG focused fund (and if so, whether the fund is also an ESG impact fund).

Also under Item C.3(j), a fund implementing its ESG strategy with information from ESG providers would be required to identify them (by name and LEI), and to state whether those providers are affiliated with the fund. Additionally, a fund would be required to state whether it follows any ESG frameworks (and if so to identify them). Index funds would need to identify any ESG indexes tracked.

The proposed amendments to Form N-CEN do not apply to business development companies, as they are not required to file it.

To view the SEC’s proposed new text in Form N-CEN, see pages 348-350 of the Proposal.

Form ADV (UNIFORM APPLICATION FOR INVESTMENT ADVISER REGISTRATION AND REPORT BY EXEMPT REPORTING ADVISERS), Part 1A

In the investment adviser’s registration application disclosure in Part 1A of Form ADV, the SEC proposes to require ESG related, census-type information which would complement advisers’ proposed narrative disclosures in their brochures (see above).

In Part 1A’s Item 5 (“Information About Your Advisory Business”), section 5.K and corresponding sections of Schedule D would require disclosure about an adviser’s uses of ESG factors, in its strategies for separately managed accounts (SMAs) and reported private funds. This includes whether the adviser employs an approach of “E”, “S” or “G”, and whether it identifies as an ESG integration fund or ESG focus fund (and if the latter, whether an ESG impact fund). The SEC also proposes to add a subsection M, for advisers to identify any third-party ESG frameworks they follow. These Item 5 amendments would apply only to advisers that are registered (or required to be registered) with the SEC.

Item 6 (“Other Business Activities”), Item 7 (“Financial Industry Affiliations and Private Fund Reporting”) and corresponding sections of Schedule D would be also amended, to consider advisers that are ESG consultants or service providers, or advisers with related persons that are ESG consultants or service providers. Registered advisers as well as exempt reporting advisers[ix] would be subject to these Item 6 and 7 requirements.

To consult the SEC’s proposed amendments to Part 1A of Form ADV, go to pages 354-358 of the Proposal.

Compliance policies and procedures

In its Proposal the SEC observes that currently, advisers are often not effectively addressing the incorporation of ESG factors into their compliance processes. With a reminder that the Investment Advisers Act and Investment Company Act require advisers and funds to maintain and annually review policies and procedures designed to prevent violations of applicable laws, the SEC affirms that its proposed ESG related disclosures (when finalized) should be part of those policies and procedures.

The SEC illustrates with some examples of effective ESG related compliance practices, on pages 167-168 of the Proposal.

Sending comments

Comments on the Proposal may be submitted, until 60 days after its publication in the Federal Register, by any of the following methods:

- online at https://www.sec.gov/rules/proposed.shtml

- by e-mail to rule-comments@sec.gov

- by postal mail to:

Vanessa Countryman, Secretary

Securities and Exchange Commission

100 F Street NE, Washington, DC 20549-0609

See further instructions at the SEC’s page “How to Submit Comments”.

[i] On the same date of May 25th, and by the same 3-1 vote, the SEC also proposed changes to the Investment Company Act’s “Names Rule”, which would regulate the naming of funds that consider ESG factors in their investment decisions, as well as those that reflect certain investment strategies in their name such as “growth” or “value”. Under the proposal, such funds would be required to adhere to the “80% investment policy” rule, by which that proportion of investments must reflect the fund name.

[ii] The SEC states:

“When referring to a ‘fund’ in this release, we variously mean management investment companies registered on Form N-1A or Form N-2, unit investment trusts registered on Form S-6, and BDCs, but not private funds as defined under the Advisers Act.”

SEC, Proposed Rule, RIN: 3235-AM96, “Enhanced Disclosures by Certain Investment Advisers and Investment Companies about Environmental, Social, and Governance Investment Practices” (25 May 2022) (“SEC Proposed Rule”), Sec. I. INTRODUCTION (p. 8, ft. 4), at https://www.sec.gov/rules/proposed/2022/ia-6034.pdf.

[iii] The SEC repeats this position with respect to various disclosure obligations it covers in its Proposal, and then solicits comments from readers on its approach. For example, with respect to prospectus disclosure requirements:

“Is this approach appropriate? Should we seek to define “ESG” or any of its subparts in the forms? Should we provide a non-exhaustive list of examples of ESG factors in the forms? Should we define certain types of factors as being ESG but allow funds to add additional factors to that concept if they choose? Are there any other approaches that we should take in providing guidance to funds as to what constitutes ESG?”

SEC Proposed Rule, Sec. II. DISCUSSION, A.1 (pp. 24-25).

[iv] This requirement would apply to ESG focused funds that respond, in a proposed new Item 3.C(j)(ii) of their annual Formulaire N-CEN, that they consider environmental factors for their investments. An exception is made for such funds that affirmatively state, in their prospectus’ “ESG strategy overview” table, that they do not consider issuers’ GHG emissions as part of their investment strategy. See SEC Proposed Rule, Sec. II. DISCUSSION, A.3 (pp. 88-89) and TEXT OF PROPOSED RULE AND FORM AMENDMENTS, Form N1-A (p. 324) and Form N-2 (p. 339).

[v] The Proposal defines a private fund as “an entity that would be an investment company but for Section 3(c)(1) or 3(c)(7) of the Investment Company Act.” SEC, Proposed Rule, Sec. II. DISCUSSION, A.3 (p. 100). This would include for example hedge funds.

[vi] The SEC acknowledges that this flexible approach, for making estimates of portfolio companies’ Scope 1 and Scope 2 GHG emissions, will result in inconsistent data. It maintains nevertheless that the approach will “provide investors with an effective depiction of the GHG emissions associated with [a] fund’s investments and provide a reasonable basis for comparison among funds”. SEC Proposed Rule, Sec. II. DISCUSSION, A.3 (p. 106).

[vii] The seven greenhouse gases are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), nitrogen trifluoride (NF3), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs) and sulfur hexafluoride (SF6). SEC Proposed Rule, Sec. II. DISCUSSION, A.3 (p. 99, ft. 154), TEXT OF PROPOSED RULE AND FORM AMENDMENTS, Form N-1A, Item 27, Instructions (p. 327) and Form N-2, Item 24, Instructions (p. 342).

[viii] A wrap fee program is a service that includes investment advice, brokerage services and administrative expenses under one bundled fee.

[ix] Exempt reporting advisers are advisers exempt under sections 203(l) and 203(m) of the Advisers Act. SEC Proposed Rule, Sec. II. DISCUSSION, C (p. 148).

I am raw html block.

Click edit button to change this html

Subscribe today and receive our latest industry updates and articles.

You may unsubscribe at anytime with our simple “unsubscribe” link at the bottom of each communication. Please see our privacy notices below for further information, including a list of affiliates covered by this consent.