State Examinations on the Rise

The Securities and Exchange Commission is not the only regulatory body increasing the number of examinations in 2021. On September 20, 2021, NASAA released their results from a series of 1,206 coordinated examinations of state-registered investment advisers by state securities examiners.

NASAA released the results of these targeted examinations, which we thought would be helpful to share. But first some background on the target audience. The examinations were conducted virtually of state registered advisers in 42 U.S. jurisdictions between January 1 – July 7, 2021. The data revealed that 289 investment advisers were examined for the first time ever by the states. Of those examined, some 68 percent were one-person firms.

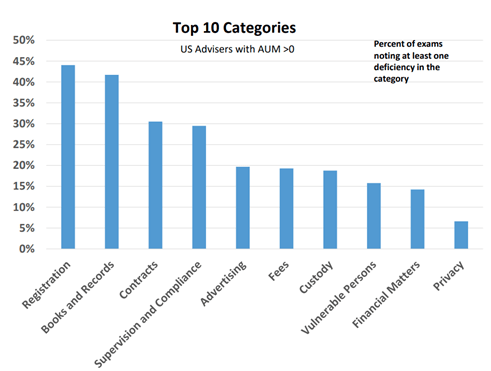

NASAA ranked the number of deficiencies and found the top three deficiencies were registration (44%), books and records (41.7%) and contracts (30.5%). Additional deficiencies included supervision and compliance (29.5%) and advertising (19.7%) which rounded out the top five leading areas of deficiencies.

Other areas of focus by the examiners were fee disclosure and the consistency of fee schedules between the advisory agreement and what is actually being charged. The report also highlights the importance of investment advisers maintaining cybersecurity policies and policies on the protection of senior and vulnerable persons. Here is a snapshot of other deficiencies noted by the state examiners:

https://www.nasaa.org/wp-content/uploads/2021/09/2021-Coordinated-IA-Exams-Public-Final-9-10-21.pdf

Based on the 2021 data, NASAA recommended the following “Best Practices” as a guide to assist investment advisers in developing robust compliance practices and procedures:

- Review and revise Form ADV and disclosure brochure annually to reflect current and accurate information.

- Review and update all contracts.

- Prepare and maintain all required records, including financial records. Back-up electronic data and protect records. Document checks forwarded.

- Prepare and maintain client profiles or other client suitability information. Maintain due diligence file for recommended products or strategy.

- Prepare a written compliance and supervisory procedures manual relevant to the type of business to include business continuity plan and information security policies/procedures.

- Prepare and distribute a privacy policy initially and annually. Be aware of confidential information transmitted via unsecure means.

- Keep accurate and current financials. File timely with the jurisdiction. Maintain surety bond if required.

- Calculate and document fees correctly in accordance with contracts and ADV.

- Review all advertisements, including website and social media for accuracy.

- Implement appropriate custody safeguards, especially for direct fee deduction. Prepare and send appropriate fee invoices to clients.

- Add policies/procedures for seniors/vulnerable persons to include training of personnel.

NASAA and state regulators continue to be very busy these days. There are a significant number of proposed regulations on the docket among states. Proposed rules include the continuing education requirements for investment adviser representatives, proposed model rule for investment adviser written policies and procedures and a model rule for information security and privacy just to name a few.

It is important to be prepared for a regulatory examination and even more important to have customized policies and procedures in place to help facilitate the protection of your clients’ assets.

If you are state registered, we highly recommend you subscribe to the notifications from NASAA and your specific state regulator in order to stay abreast of new rules and regulations. Similar to our great Coffee & Regs podcast, NASAA also has a good podcast series with some great content.

For more information or to speak with a regulatory expert, please email info@cssregtech.com.