EMIR REFIT FAQs

Where are we on EMIR REFIT?

As of July 2021, ESMA has published a consultation on the draft EMIR REFIT reporting guidelines, validation rules and XML. The industry has been granted three months and must answer the consultation by the end of September 2021.

ESMA is aiming at publishing the final version of the guidelines, validation rules and XML by the end of 2021 at the earliest, and Q1 2022 at the latest.

When will EMIR REFIT go-live?

There is currently no official timeline for the run-up to EMIR REFIT go-live. However, based on the draft RTS, the ESAs process for publicizing changes to existing regulations, and our experience with past regulation upgrades, we believe that possible reporting will start in H2 2023.

What is the Consultation about?

The consultation paper covers the European side of Market Infrastructure Regulation (EMIR) and provides a suggested overhaul (REFIT) of most aspects of the regulation, including regulatory framework, regulatory scope, technical setup, regulated entities and data quality.

What Firms are in Scope for this Regulation?

All EU-based firms (financial and non-financial) trading derivatives are in scope for EMIR.

What is being addressed in the consultation?

Scope of the Consultation

The Consultation Paper (CP) includes draft guidelines on a wide range of topics related to reporting, data quality and data access under EMIR REFIT. This paper will focus on the regulatory side of the consultation rather than the technical. The proposed guidelines included in the CP clarify provisions of the draft ITS and RTS on reporting that were submitted to the European Commission on 16 December 2020.

Transition to New Reporting Standards

EMIR REFIT will in the future have to be reported in the ISO 20022 XML format, which is something that is already live for SFTR. ESMA believes that this will increase data quality as it is a more robust framework than what is market practice today. Currently, different TRs will have different field specs and different file conventions, which according to ESMA, is affecting data quality as well as pairing and matching negatively. The move to ISO 20022 will also mean that different schemas will be used for different purposes. There will be one schema for counterparty and transaction data and a separate schema for margins.

As under the previous EMIR REFIT, implementation all the reports submitted after go-live will have to comply with the amended requirements, which includes all modifications and terminations on old contracts. All outstanding contracts should also be updated to follow the revised reporting

requirements within 180 days from the reporting start date using the Modify+Update action type combination.

This transition to a new technical reporting framework is something that provides a challenge for many reporting firms. While the ISO 20022 standard now is widely used, the complexity of the standard might become cumbersome for multiple reasons, including that all firms already have an existing solution and are mandated by the regulator to amend their current reporting setup.

Reportable Derivatives

Crypto Assets

For the first time ESMA has included cryptocurrency assets in the scope of the regulation. However, ESMA is highlighting that only derivatives that fulfil the EMIR definition AND the cryptocurrency asset is considered a financial instrument under MiFID and should be reported. In practice, this means that most cryptocurrency assets as we know them today are still going to be out of scope. ESMA also highlights that cryptocurrencies are not listed in the ISO 4217 standard.

Total Return Swaps

There have been some misconceptions around TRS and if they are reportable under EMIR or SFTR. ESMA’s opinion is that a TRS that falls under the derivative definition should be reported under EMIR and not SFTR. Liquidity and collateral swaps which do not fall under the definition of a derivative should be reported under SFTR.

Complex Contracts

ESMA also highlights that complex contracts (like an option on a future), should be reported as separate transactions. Market transactions that do not fall under the definition of a derivative like financial instruments with embedded derivatives (convertible bonds), structured products, etc. should also be listed.

Data Requirements

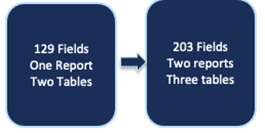

It is proposed that the data requirements under EMIR will follow the CPM IOSCO CDE (Critical Data Elements) Guidance. This means EMIR will adhere to a global framework around various data elements. It also means that the data requirement under the new EMIR REFIT will be unprecedented with roughly 200 data fields to be reported, 202 if all fields are kept after the consultation. The new data requirements also include new golden sources for validation.

The new data points added will provide a much more granular description of a wide array of tables in the report. The different data points affected are valuations, margins, clearing, payments and timestamps. The changes will affect formats, validations and accepted values.

The global alignment to CDE and the increased volume of data will surely provide a big challenge for reporting firms as there is a greater degree of standardization and golden source validations and also a greater volume of data. The CDE fields alone account for more than 50 of the new field requirements.

Data Quality

Data quality has been a major challenge in the existing regulation and ESMA is taking steps towards regulating this further. ESMA believes that the implementation of ISO 20022 as well as the more granular data requirements will improve data quality.

First, they implement a similar provision around errors and omissions as MiFIR where the entity responsible for reporting should notify the NCA promptly if there are any misreporting caused by flaws in the reporting system, reporting obstacles preventing the entity to send reports to the TR or any significant issue resulting in errors that would not cause TR rejections.

What ESMA also clearly states in the CP is that this applies to any link in the reporting chain even if the error derives from internal systems, reporting systems, third-party vendors, or other entities.

For more information on EMIR REFIT or global transaction reporting, email us at info@cssregtech.com.