Regulatory Examination Priorities & Insights

Have you been through a regulatory examination recently? If not, take heed, your time might be coming. Without even looking at the SEC 2021 statistics on the number of regulatory examinations completed, we can tell you that it has been a very busy year for the Division of Examinations.

The SEC’s 2020 Examination statistics reveal the Division of Examinations conducted almost 3,000 exams, covering 15% of the adviser population. The total number of examinations was down only 4% from 2019, and this is during the ongoing COVID-19 pandemic! The notion that maybe you are not going to be examined because of the COVID pandemic simply isn’t playing out.

The examiners have pivoted from in-person examinations to remote, which seems to result in examinations lasting longer than before. Deadlines for document production seem to be consistent with in-person exams, however the follow-up for review and discussions is taking longer. As a result, investment advisers should plan for their regulatory exams to last months, with periods of inactivity.

In addition to publishing examination statistics, the SEC also publishes its annual list of exam priorities. Publishing these areas of focus furthers the SEC’s mission of promoting transparency on expectations, but also helps ensure consistent exams regardless of which office is conducting the exam. In comparing the SEC’s 2021 Examination Priorities, we can confirm that examiners are taking these to heart and are using them as a blueprint for exams for our clients.

While there are plenty of analyses of these priorities on their own, we wanted to talk about how we are seeing them come to fruition:

- Fees, especially advisory fees, are a hot topic. Examiners are taking a hard look at fees charged, comparing to advisory agreements, and ensuring proper disclosure is made. Are you fully disclosing your fees and other compensation arrangements?

- Speaking of disclosure, have you reviewed your Form CRS since implementing it last year? Advisers had to adopt and submit their Form CRS by June 30, 2020, yet have you reviewed changes to your business which would trigger revisions to Form CRS?

And it wouldn’t be an examination priority list without the inclusion of cybersecurity, which marks almost a decade of annual inclusion. We feel it is worthy of mentioning that in Chairman Gensler’s comments to the United States Senate on September 14th, 2021 he highlighted the SEC’s mid-year agenda by saying the Commission is focused on proposing a cybersecurity rule at some point in the near future. The proposed rule would cover specific systems advisers should have in place, as well as how firms should manage their digital risks. Additionally, the proposed rule would address requirements for how advisers manage post breaches or similar incidents.

In our experience, most advisers and information technology professionals would welcome such standardized system requirements. Presently, the guidance from regulators is focused on subjective topics such as examples of best practices. Best practices are helpful, however firms can struggle with specific implementation, so having specifics laid out by the SEC would provide the guidance firms need.

Are you a newly registered investment adviser? If so, expect an examination within the first 6-8 months of opening your doors. Initially, we were seeing the new registrant examinations within 12 months of a firm receiving their provisional approval. However, now we are seeing the SEC start an exam as early as 3 months since registering. The takeaway being that you need to ensure you have a reasonably designed compliance program in effect as soon as you open your doors.

There are also new items being included on the initial document request letter from the SEC. Based on these new requests, it is very apparent the examiners want technology to be a big aspect of an Advisers’ compliance program. In a recent document request, the SEC requested a trade blotter for the past two year of all trades effected in not just client accounts, but also accounts of the Adviser’s Access Persons. Additionally, the initial document request letter included a request for a list of investments held by the Adviser’s clients, any private funds under management and each of the Adviser’s owners, senior officer and portfolio manager.

If your compliance department does not have an automated Code of Ethics reporting system, responding to these types of requests might be very challenging or even electronically impossible. For Advisers that still receive manual statements from their Access Persons for Code of Ethics reporting, providing the information requested by the SEC in this fashion would be nearly impossible.

As noted earlier, there is also a significant focus on advisory fees and compensation arrangements, particularly around sub-advisors and independent third party managers. In recent examinations, there has been great attention paid to fee billing on household accounts, pro-rated refunds for terminated accounts and the disclosure of sub-advisory fee arrangements. So, what are the takeaways from all this? Get your affairs in order and prepare your firm for an examination. Create a first-day presentation that describes your firm, its compliance program, compliance resources and technology in place. Test your fee billing practices and ensure calculations are accurate and disclosure is consistent with your practices. Even better, consider going through a mock SEC examination to test your preparedness.

For more information or to speak with a regulatory expert, please email info@cssregtech.com.

News for Short Position Holders on EU Markets

Big news for short position holders on EU markets. European Commission adopts lowering of reporting threshold to 0.1%. Entry into force: 20 days after publication in the Official Journal of the European Union. See more here.

State Examinations on the Rise

The Securities and Exchange Commission is not the only regulatory body increasing the number of examinations in 2021. On September 20, 2021, NASAA released their results from a series of 1,206 coordinated examinations of state-registered investment advisers by state securities examiners.

NASAA released the results of these targeted examinations, which we thought would be helpful to share. But first some background on the target audience. The examinations were conducted virtually of state registered advisers in 42 U.S. jurisdictions between January 1 – July 7, 2021. The data revealed that 289 investment advisers were examined for the first time ever by the states. Of those examined, some 68 percent were one-person firms.

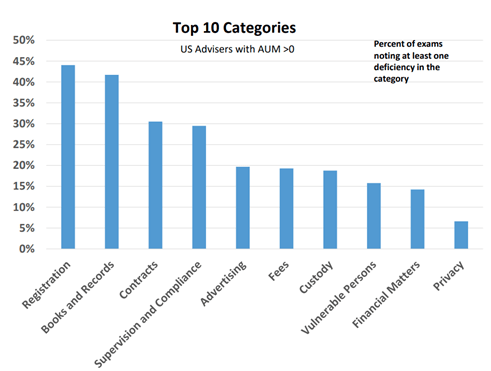

NASAA ranked the number of deficiencies and found the top three deficiencies were registration (44%), books and records (41.7%) and contracts (30.5%). Additional deficiencies included supervision and compliance (29.5%) and advertising (19.7%) which rounded out the top five leading areas of deficiencies.

Other areas of focus by the examiners were fee disclosure and the consistency of fee schedules between the advisory agreement and what is actually being charged. The report also highlights the importance of investment advisers maintaining cybersecurity policies and policies on the protection of senior and vulnerable persons. Here is a snapshot of other deficiencies noted by the state examiners:

https://www.nasaa.org/wp-content/uploads/2021/09/2021-Coordinated-IA-Exams-Public-Final-9-10-21.pdf

Based on the 2021 data, NASAA recommended the following “Best Practices” as a guide to assist investment advisers in developing robust compliance practices and procedures:

- Review and revise Form ADV and disclosure brochure annually to reflect current and accurate information.

- Review and update all contracts.

- Prepare and maintain all required records, including financial records. Back-up electronic data and protect records. Document checks forwarded.

- Prepare and maintain client profiles or other client suitability information. Maintain due diligence file for recommended products or strategy.

- Prepare a written compliance and supervisory procedures manual relevant to the type of business to include business continuity plan and information security policies/procedures.

- Prepare and distribute a privacy policy initially and annually. Be aware of confidential information transmitted via unsecure means.

- Keep accurate and current financials. File timely with the jurisdiction. Maintain surety bond if required.

- Calculate and document fees correctly in accordance with contracts and ADV.

- Review all advertisements, including website and social media for accuracy.

- Implement appropriate custody safeguards, especially for direct fee deduction. Prepare and send appropriate fee invoices to clients.

- Add policies/procedures for seniors/vulnerable persons to include training of personnel.

NASAA and state regulators continue to be very busy these days. There are a significant number of proposed regulations on the docket among states. Proposed rules include the continuing education requirements for investment adviser representatives, proposed model rule for investment adviser written policies and procedures and a model rule for information security and privacy just to name a few.

It is important to be prepared for a regulatory examination and even more important to have customized policies and procedures in place to help facilitate the protection of your clients’ assets.

If you are state registered, we highly recommend you subscribe to the notifications from NASAA and your specific state regulator in order to stay abreast of new rules and regulations. Similar to our great Coffee & Regs podcast, NASAA also has a good podcast series with some great content.

For more information or to speak with a regulatory expert, please email info@cssregtech.com.

Third-Country Markets Considered as Equivalent to a Regulated Market in the Union for OTC Derivatives Reporting

ESMA has released an updated list of third-country markets considered as equivalent to a regulated market in the Union for the purposes of reporting exchange-traded derivatives under EMIR. It is worth noting that amongst the five regulated markets added to the list, ESMA has included crypto asset derivatives markets as equivalent to a regulated market, certainly in preparation of EMIR REFIT. EMIR firms trading in derivatives on any of the newly added exchanges will have to comply with the validations relating to fields 2.15 “venue of execution,” 2.5 “product identification type,” 2.34 “clearing obligation” and 2.38 “intragroup.”

The full list of exchanges considered as equivalent to a regulated market can be found here.

EMIR REFIT FAQs

Where are we on EMIR REFIT?

As of July 2021, ESMA has published a consultation on the draft EMIR REFIT reporting guidelines, validation rules and XML. The industry has been granted three months and must answer the consultation by the end of September 2021.

ESMA is aiming at publishing the final version of the guidelines, validation rules and XML by the end of 2021 at the earliest, and Q1 2022 at the latest.

When will EMIR REFIT go-live?

There is currently no official timeline for the run-up to EMIR REFIT go-live. However, based on the draft RTS, the ESAs process for publicizing changes to existing regulations, and our experience with past regulation upgrades, we believe that possible reporting will start in H2 2023.

What is the Consultation about?

The consultation paper covers the European side of Market Infrastructure Regulation (EMIR) and provides a suggested overhaul (REFIT) of most aspects of the regulation, including regulatory framework, regulatory scope, technical setup, regulated entities and data quality.

What Firms are in Scope for this Regulation?

All EU-based firms (financial and non-financial) trading derivatives are in scope for EMIR.

What is being addressed in the consultation?

Scope of the Consultation

The Consultation Paper (CP) includes draft guidelines on a wide range of topics related to reporting, data quality and data access under EMIR REFIT. This paper will focus on the regulatory side of the consultation rather than the technical. The proposed guidelines included in the CP clarify provisions of the draft ITS and RTS on reporting that were submitted to the European Commission on 16 December 2020.

Transition to New Reporting Standards

EMIR REFIT will in the future have to be reported in the ISO 20022 XML format, which is something that is already live for SFTR. ESMA believes that this will increase data quality as it is a more robust framework than what is market practice today. Currently, different TRs will have different field specs and different file conventions, which according to ESMA, is affecting data quality as well as pairing and matching negatively. The move to ISO 20022 will also mean that different schemas will be used for different purposes. There will be one schema for counterparty and transaction data and a separate schema for margins.

As under the previous EMIR REFIT, implementation all the reports submitted after go-live will have to comply with the amended requirements, which includes all modifications and terminations on old contracts. All outstanding contracts should also be updated to follow the revised reporting

requirements within 180 days from the reporting start date using the Modify+Update action type combination.

This transition to a new technical reporting framework is something that provides a challenge for many reporting firms. While the ISO 20022 standard now is widely used, the complexity of the standard might become cumbersome for multiple reasons, including that all firms already have an existing solution and are mandated by the regulator to amend their current reporting setup.

Reportable Derivatives

Crypto Assets

For the first time ESMA has included cryptocurrency assets in the scope of the regulation. However, ESMA is highlighting that only derivatives that fulfil the EMIR definition AND the cryptocurrency asset is considered a financial instrument under MiFID and should be reported. In practice, this means that most cryptocurrency assets as we know them today are still going to be out of scope. ESMA also highlights that cryptocurrencies are not listed in the ISO 4217 standard.

Total Return Swaps

There have been some misconceptions around TRS and if they are reportable under EMIR or SFTR. ESMA’s opinion is that a TRS that falls under the derivative definition should be reported under EMIR and not SFTR. Liquidity and collateral swaps which do not fall under the definition of a derivative should be reported under SFTR.

Complex Contracts

ESMA also highlights that complex contracts (like an option on a future), should be reported as separate transactions. Market transactions that do not fall under the definition of a derivative like financial instruments with embedded derivatives (convertible bonds), structured products, etc. should also be listed.

Data Requirements

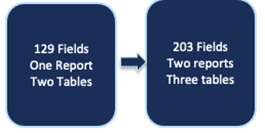

It is proposed that the data requirements under EMIR will follow the CPM IOSCO CDE (Critical Data Elements) Guidance. This means EMIR will adhere to a global framework around various data elements. It also means that the data requirement under the new EMIR REFIT will be unprecedented with roughly 200 data fields to be reported, 202 if all fields are kept after the consultation. The new data requirements also include new golden sources for validation.

The new data points added will provide a much more granular description of a wide array of tables in the report. The different data points affected are valuations, margins, clearing, payments and timestamps. The changes will affect formats, validations and accepted values.

The global alignment to CDE and the increased volume of data will surely provide a big challenge for reporting firms as there is a greater degree of standardization and golden source validations and also a greater volume of data. The CDE fields alone account for more than 50 of the new field requirements.

Data Quality

Data quality has been a major challenge in the existing regulation and ESMA is taking steps towards regulating this further. ESMA believes that the implementation of ISO 20022 as well as the more granular data requirements will improve data quality.

First, they implement a similar provision around errors and omissions as MiFIR where the entity responsible for reporting should notify the NCA promptly if there are any misreporting caused by flaws in the reporting system, reporting obstacles preventing the entity to send reports to the TR or any significant issue resulting in errors that would not cause TR rejections.

What ESMA also clearly states in the CP is that this applies to any link in the reporting chain even if the error derives from internal systems, reporting systems, third-party vendors, or other entities.

For more information on EMIR REFIT or global transaction reporting, email us at info@cssregtech.com.

What’s Next for PRIIPs?

Here’s a quick update on the various moving parts on PRIIPs and the RTS as it moves through the EU legislative process. In our last update, we announced the milestone of PRIIPs being approved by the Commission (7 September 2021). This now kick starts the co-legislative scrutiny period which typically is two months, with the option for an additional month’s review. In the interim, there is intense advocacy and lobbying persisting to have a 12 month run into the effective date. If successful, this would push the date in the RTS from 1 July 2022 to 1 January 2023. The outcome of this lobbying will become clearer as we progress through the scrutiny period.