Shareholding Disclosure Requirements for Investment Managers

Shareholding disclosure rules can be complicated, and this is particularly true for investment managers making disclosures in respect of their managed holdings. Before considering the thresholds and any applicable exemptions, an investment manager needs to know whether its discretionary mandate triggers the disclosure rules in the relevant jurisdiction.

How does an investment manager determine whether it has a disclosable interest? Is disclosure triggered by voting discretion, legal title, beneficial interest or some broader interest in shares?

The same mandate can produce different disclosure outcomes depending on the country.

Where the investment manager has to make a disclosure, there are further questions to consider:

- Does the investment manager need to provide fund information in the disclosure form?

- What about the fund and any sub-manager? Do they need to disclose?

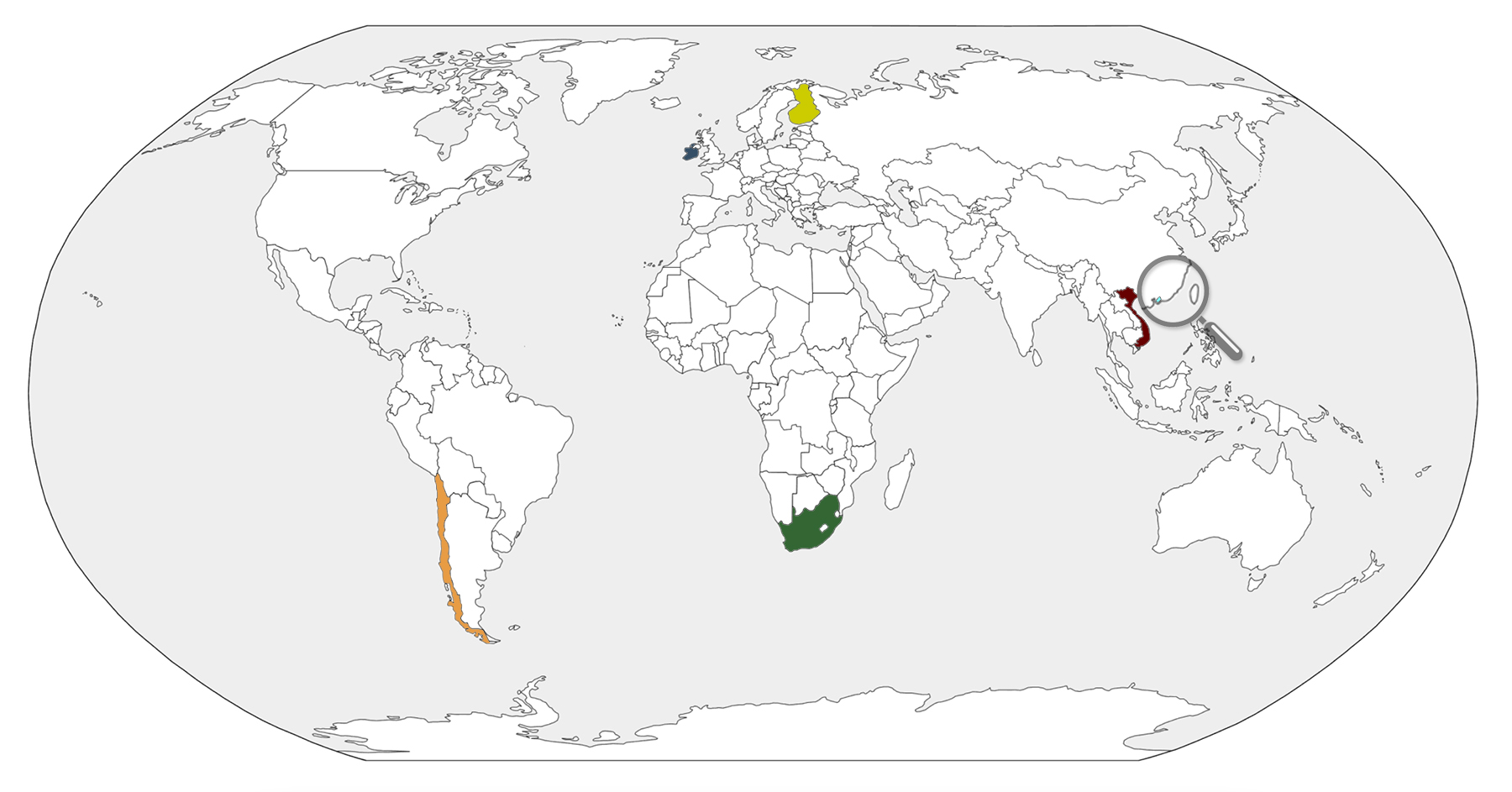

The map shows how the same investment management scenario can result in different disclosure outcomes depending on the jurisdiction.

In this scenario, the manager has voting and investment discretion. A custodian holds the shares on behalf of the fund. More detail in Rulefinder Shareholding Disclosure, including additional scenarios, e.g., managed accounts, use of a sub-manager. Rules on corporate aggregation may affect the disclosure position in practice.

* This map includes content derived from Rulefinder Shareholding Disclosure (as of September 2021), the online legal service from aosphere LLP. CSS collaborates with aosphere to source legal content for our Investment Monitoring rules engine. Nothing in this summary is intended to provide legal or other professional advice: aosphere does not accept responsibility for loss which may arise from reliance on this summary.